1. According to the SMM survey, coke enterprises' profit per ton of coke was 31.7 yuan/mt this week, with profits narrowing.

From a pricing perspective, coke prices underwent the ninth round of price cuts this week, with a reduction of 50-55 yuan/mt. The price cuts negatively impacted coke enterprises' profit per ton of coke. From a cost perspective, most coal mines have resumed normal production, and coking coal supply remained at high levels. The ample supply led to a decline in coking coal prices, which helped restore coke enterprises' profits.

Next week, the tenth round of coke price cuts is expected, but coking coal prices are also under pressure. Both prices and costs may decline simultaneously, and coke enterprises' profit per ton of coke may decrease slightly.

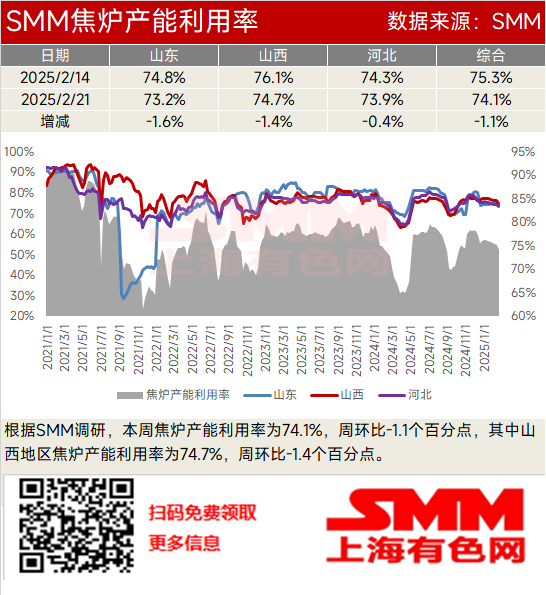

2. According to the SMM survey, the coke oven capacity utilisation rate was 74.1% this week, down 1.1 percentage points WoW. In Shanxi, the coke oven capacity utilisation rate was 74.7%, down 1.4 percentage points WoW.

From a profitability perspective, most coke enterprises' profits remained at the break-even level, with minimal impact on production. From an inventory perspective, coke enterprises faced sluggish sales, and with coke supply remaining high, their already high inventories continued to build up, dampening production enthusiasm. From an environmental protection perspective, environmental protection policies in Shanxi, Hebei, and Shandong have not tightened, with no significant impact on coke enterprises' production.

Subsequently, most coke enterprises face relatively low risks of losses, and even if losses occur, they remain within tolerable limits for most enterprises. A small number of coke enterprises may reduce production, and coke supply is expected to remain ample. However, the recovery of the end-use market has been slow, falling short of market expectations, and coke inventories at steel mills remain at safe levels, with steel mills primarily purchasing as needed. In summary, the ample coke supply situation is unlikely to change in the short term, and the coke oven capacity utilisation rate of coke enterprises may decrease slightly next week.

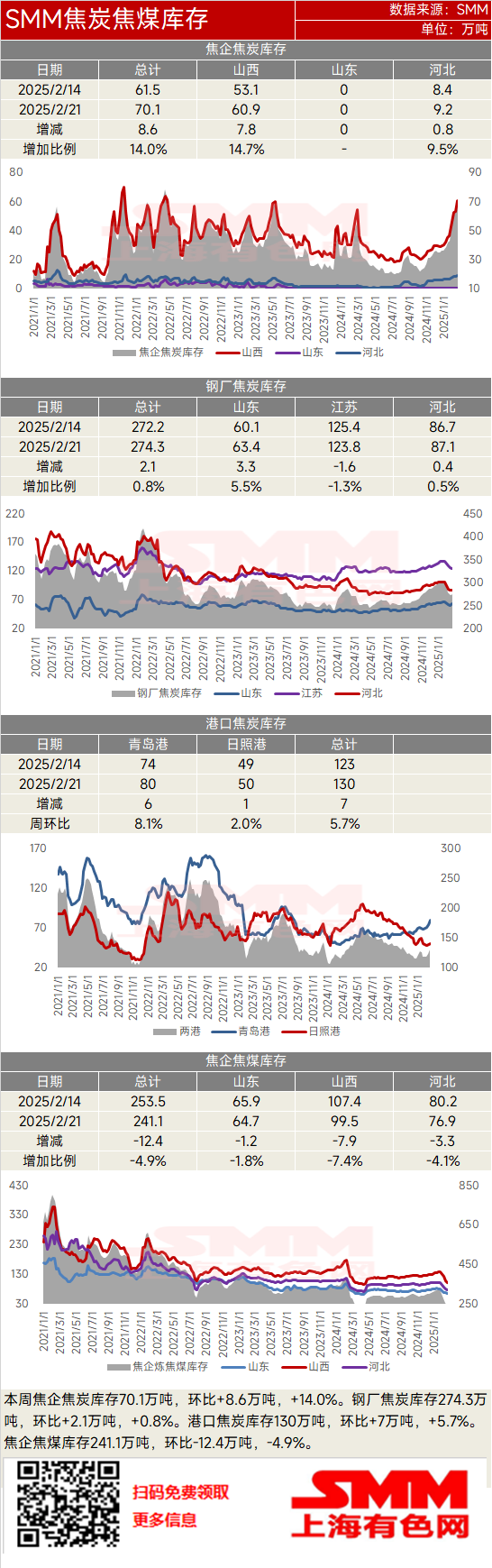

3. This week, coke enterprises' coke inventory stood at 701,000 mt, up 86,000 mt (+14.0%) WoW. Steel mills' coke inventory was 2.743 million mt, up 21,000 mt (+0.8%) WoW. Port coke inventory was 1.3 million mt, up 70,000 mt (+5.7%) WoW. Coke enterprises' coking coal inventory was 2.411 million mt, down 124,000 mt (-4.9%) WoW.

This week, coke enterprises' coke inventory continued to build up, while steel mills' coke inventory saw a slight increase. Most coke enterprises' profits remained at the break-even level, with production conditions barely stable. However, downstream end-users showed moderate purchasing enthusiasm, and coke enterprises' coke inventory fluctuated at high levels. Steel mills' order performance was relatively good this week, with some mills purchasing normally. However, steel mills showed a strong inclination to seek profits upstream, primarily purchasing as needed to suppress coke prices.

Subsequently, most coke enterprises are expected to maintain profitability, and even if losses occur, they will remain within tolerable limits. Overall production conditions are stable, but due to high inventories and sluggish sales, some coke enterprises may slightly reduce production. However, the end-use market expectations for steel mills remain moderate, and with coke inventories at safe levels, only a few steel mills may restock next week. Therefore, coke enterprises are expected to continue inventory buildup next week, while steel mills' coke inventory may fluctuate rangebound.

This week, coke supply remained ample, and the market anticipates the tenth round of coke price cuts. However, some traders hold expectations for policies from the Two Sessions and slightly restocked inventories. Port coke inventory may increase next week.

This week, coke enterprises' coking coal inventory continued to decline, mainly because most coal mines have resumed normal production, with their coking coal inventories at high levels. The ample supply, coupled with normal coking coal inventories at downstream coke enterprises and steel mills, led to moderate restocking demand. Subsequently, coking coal supply is expected to remain high, with market logistics returning to normal and concentrated restocking demand significantly weakening. Coke enterprises' coking coal inventory is expected to continue declining next week.

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)